Health insurance rates are about to jump for thousands of WA residents

By Alison Saldanha

On September 15, 2023

Health insurance premiums paid by more than 200,000 Washington residents will increase by an average of nearly 9% next year, with some rising by as much as 17.8%.

The state Office of the Insurance Commissioner has approved an average increase of 8.94% for 14 health insurers operating in Washington’s individual health insurance market, lower than the 9.11% hike the companies requested earlier this year.

Premiums for coverage provided by Kaiser Foundation Health Plan of Washington, Premera Blue Cross and Bridgespan Health Co. will see double-digit increases.

Nearly 1 in 6 Washington residents directly purchase their own insurance, according to 2022 census data. About 1 in 3 are over the age of 65.

How health insurance companies’ premiums will change in 2024

Hikes in premiums for Kaiser Foundation Health Plan of Washington, Premera Blue Cross and Bridgespan Health Co. will impact nearly a third of consumers buying insurance from the individual market.

| Health insurance company | Requested rate change | Approved rate change | |

| 1 | Kaiser Foundation Health Plan of Washington | 17.9% | 17.8% |

|---|---|---|---|

| 2 | Premera Blue Cross | 15.8% | 17.2% |

| 3 | BridgeSpan Health Co. | 15.2% | 16.4% |

| 4 | PacificSource Health Plan | 7.2% | 8.5% |

| 5 | Regence BlueCross BlueShield of Oregon | 6.5% | 8.4% |

| 6 | LifeWise Health Plan of Washington | 7.8% | 7.8% |

| 7 | Kaiser Foundation Health Plan of the Northwest | 8.8% | 7.3% |

| 8 | Molina Healthcare of Washington, Inc. | 6.4% | 6.5% |

| 9 | Coordinated Care Corporation | 5.2% | 4.9% |

| 10 | Providence Health Plan | 4.7% | 4.7% |

| 11 | Regence BlueShield | 4.5% | 4.4% |

| 12 | UnitedHealthcare of Oregon, Inc. | 2.8% | −0.5% |

| 13 | Community Health Plan of Washington | 2.5% | −1.2% |

| 14 | Asuris Northwest Health | −3.4% | −7% |

“Insurance premiums are just one part of the outrageous medical costs that patients are forced to absorb,” said John Godfrey, a small-business owner and lead organizer for Washington CAN, a grassroots organization focused on racial, gender and economic justice. The organization submitted more than 250 letters from concerned Washingtonians to the Insurance Commissioner’s Office, describing the effects of high health care prices.

“Combine those premiums, deductibles and out-of-pocket expenses with the uncontrolled hospital and prescription drug costs, and the bottom line is people can’t afford to get sick,” Godfrey said.

As of July, an estimated 220,059 residents were covered through the individual health insurance market, which is designed for people who do not receive health insurance from their employer.

Nearly 90% bought coverage through the state-run Washington Health Benefit Exchange, through which more than 75% received some financial help to pay their monthly premiums.

How much an individual pays depends on the plan they select, the number of people covered under the insurance policy, their age and whether they smoke, as well as where they live.

Four in five Washingtonians expressed concerns about affording health care in the future, according to a 2022 survey of over 1,300 Washington adults by Altarum Healthcare Value Hub, a research resource for health care for policymakers, advocates and health officials. Among those uninsured, affordability was the primary reason, according to the report. More than half of the respondents also reported delaying or going without health care services in the prior year due to cost.

Medical treatment has left nearly 5% of Washington residents in debt, according to census data analyzed by Urban Institute, a nonprofit research organization. Residents of color were more likely to be in debt, and Asotin and Garfield counties in Eastern Washington and Pierce County hold the largest share of residents in medical debt.

“You shouldn’t have to be wealthy to be healthy,” said Sam Hatzenbeler, a senior policy associate at the Economic Opportunity Institute, a Washington-based nonprofit. “While there is no single answer to address all of the problems of the health care system, there are data-driven policy solutions that work, including giving the state more tools to monitor health spending and health system consolidation.”

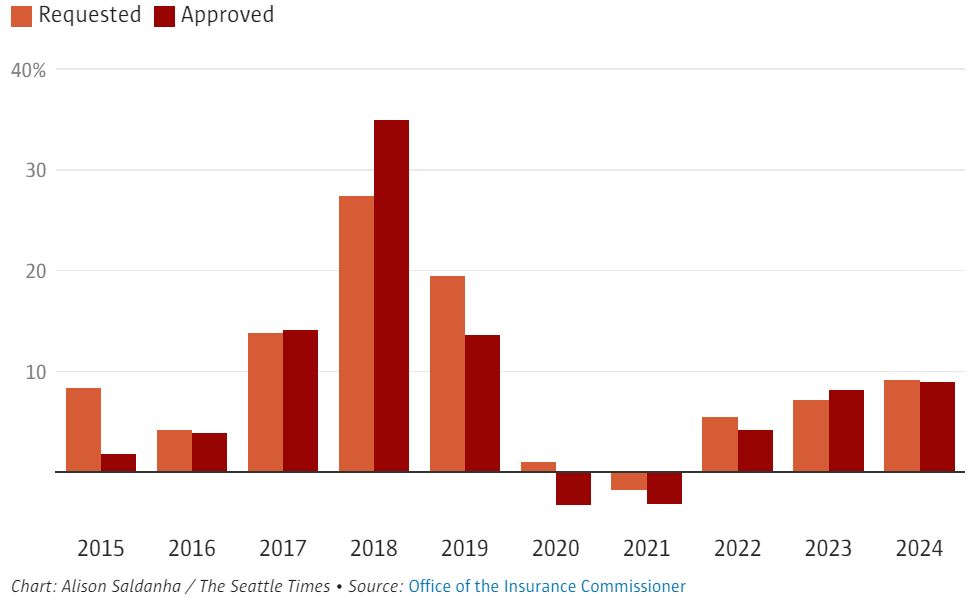

Rate changes health insurance companies requested and received over the decade

Health insurance premiums in the individual market will increase for the third consecutive year in 2024 after monthly premiums dropped during the pandemic because of funding provided by the American Rescue Plan.

Insurance Commissioner Mike Kreidler admitted he was “deeply concerned” about what these rate increases mean for individuals and families.

“We need to do the hard work of getting at the underlying costs of health care,” he said, calling out high reimbursements to hospitals and health care providers as one of the factors driving up health care costs.

When reviewing proposed changes to health insurance premium costs, the Insurance Commissioner’s Office said it takes into consideration increased costs of prescription drugs, a growing demand and backlog for elective surgeries, and payments insurers received or are owed through the Affordable Care Act’s risk-adjustment program.

The risk-adjustment program is meant to stabilize the insurance market for individuals and small groups by redistributing federally collected funds from insurers that attract lower-risk enrollees to insurers that attract higher-risk enrollees.

“This was created because insurers have to take everyone regardless of their health condition,” said Stephanie Marquis, Insurance Commissioner’s Office public affairs director. “So some insurers get paid from the fund and others owe money.”

Since assessments for that program take place after insurers file their initial requests for rate changes, the Insurance Commissioner’s Office allows a course correction before approving rates, Marquis said.

“That makes some rate requests go up to account for those payments,” she said.

Marquis added that the 35% hike accepted in 2018, when insurers requested only a 27.4% boost, was mostly meant to offset the increase in costs insurers were taking on after the federal government withdrew support for a cost-sharing reduction program in place at that time under the Affordable Care Act.

“In the absence of federal assistance, the cost-sharing benefit was then borne entirely by the insurance companies,” Marquis said.

Kreidler said his office will be doing more work to support recent legislative efforts to strengthen competition in the industry and tackle rising health care costs.

This piece was republished from the Seattle Times.